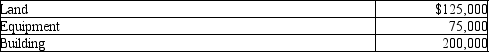

Hastings Company has purchased a group of assets for $350,000. The assets and their market values are listed as follows:  Which of the following amounts would be debited to the Land account?

Which of the following amounts would be debited to the Land account?

A) $125,000

B) $109,375

C) $65,625

D) $175,000

Correct Answer:

Verified

Q2: Treating a capital expenditure as an expense

Q3: Which of the following is included in

Q4: The cost of land includes the cost

Q8: Which of the following costs related to

Q10: A company's accountant capitalizes a payment that

Q12: Which of the following would be capitalized

Q13: Expenditures which extend the life of an

Q14: A company's accountant expenses a payment that

Q16: The cost of fencing around a building

Q17: Which of the following asset categories would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents