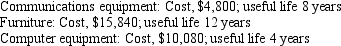

Hank's Tax Planning Service has the following plant assets:

Hank's monthly depreciation expense is:

Hank's monthly depreciation expense is:

A)$2,560.

B)$4,440.

C)$210.

D)$370.

Correct Answer:

Verified

Q102: Hank's Tax Planning Service bought computer equipment

Q106: Hank's Tax Planning Service has the following

Q106: Hank's Tax Planning Service started business in

Q107: On July 1, Alpha Company prepaid rent

Q107: A company received $5,000 for 100 one-year

Q108: Real Losers, a diet magazine, collected $360,000

Q114: Hank's Tax Planning Service bought communications equipment

Q114: On April 1, Balsa Company purchased $800

Q117: What type of account is Unearned revenue

Q118: What type of account is Prepaid rent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents