Art Parrish, the sole employee of Parrish Sales, has gross salary for March of $4,000. The entire amount is under the OASDI limit of $106,800, and thus subject to FICA. He is also subject to federal income tax at a rate of 18%. Please provide the second entry in the payroll cycle to record the disbursement of his net pay.

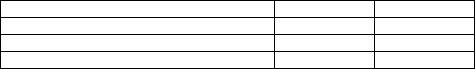

Correct Answer:

Verified

Q126: Art Parrish is the sole employee of

Q131: Art Parrish,the sole employee of Parrish Sales,has

Q133: The Statewide Sales Company has gross pay

Q134: Which of the following is included in

Q135: Art Parrish,the sole employee of Parrish Sales,has

Q143: Art Parrish is the sole employee of

Q144: Which of the following is an important

Q148: Art Parrish,the sole employee of Parrish Sales,has

Q155: Which of the following is an important

Q158: Which of the following is a control

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents