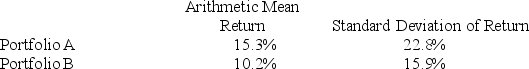

The table below gives statistics relating to a hypothetical 10-year record of two portfolios. Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.  Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

A) Portfolio A because it has a higher coefficient of variation and a lower Sharpe ratio

B) Portfolio A because it has a lower coefficient of variation and a higher Sharpe ratio

C) Portfolio B because it has a higher coefficient of variation and a lower Sharpe ratio

D) Portfolio B because it has a lower coefficient of variation and a higher Sharper ratio

Correct Answer:

Verified

Q75: As of September 30, the earnings per

Q76: The mean return on equity (ROE) for

Q77: Which are characteristic(s) of the coefficient of

Q78: The Sharpe ratio measures _.

A) the extra

Q79: Professors at a local university earn an

Q81: Which of the following is true when

Q82: In its standard form, Chebyshev's theorem provides

Q83: The empirical rule can be used to

Q84: Amounts spent by a sample of 200

Q85: Professors at a local university earn an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents