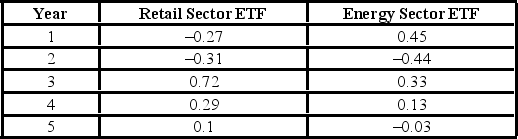

The following is return data for a retail sector ETF and energy sector ETF for the years, Year 1 to Year 5.  (See the Excel Data File.)

(See the Excel Data File.)

A) What is the arithmetic mean return for each ETF?

B) What is the geometric mean return for each ETF?

C) What is the sample standard deviation for each ETF? Which ETF was riskier over this time period?

D) Given a risk free rate of 5%, what is the Sharpe Ratio for each ETF? Which investment had a better return per unit of risk over this time period?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q129: The following table shows the annual returns

Q130: Suppose the wait to pass through immigration

Q131: Suppose the average price for new cars

Q132: The Yearly Prices (rounded to the nearest

Q133: John lives in Los Angeles and hates

Q135: The director of graduate admissions is analyzing

Q136: The following is a list of average

Q137: Suppose the dealer incentive per vehicle for

Q138: The following data are a list of

Q139: Janice Anooshian asks eight of her friends

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents