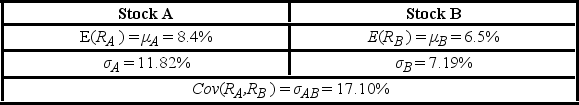

An investor has a $200,000 portfolio of which $120,000 has been invested in Stock A and the remainder in Stock B. Other characteristics of the portfolio are shown in the accompanying table.  The correlation coefficient between the returns on Stocks A and B is ________.

The correlation coefficient between the returns on Stocks A and B is ________.

A) -0.17

B) 0.20

C) 0.80

D) 4.97

Correct Answer:

Verified

Q72: The number of cars sold by a

Q73: Thirty percent of the CFA candidates have

Q74: An investor has a $200,000 portfolio of

Q75: On a particular production line, the likelihood

Q76: Thirty percent of the CFA candidates have

Q78: On a particular production line, the likelihood

Q79: On a particular production line, the likelihood

Q80: It is known that 10% of the

Q81: Which of the following statements is the

Q82: For a particular clothing store, a marketing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents