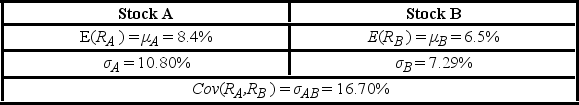

Given the information in the accompanying table, calculate the correlation coefficient between the returns on Stocks A and B.

A) -0.212

B) -0.167

C) 0.167

D) 0.212

Correct Answer:

Verified

Q64: An investor has a $100,000 portfolio of

Q65: A consumer who is risk neutral is

Q66: It is known that 10% of the

Q67: An investor has a $200,000 portfolio of

Q68: How would you characterize a consumer who

Q70: It is known that 10% of the

Q71: Which of the following statements is the

Q72: The number of cars sold by a

Q73: Thirty percent of the CFA candidates have

Q74: An investor has a $200,000 portfolio of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents