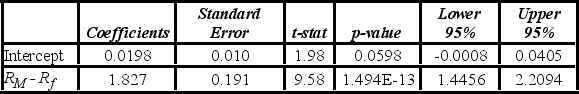

Tiffany & Co. has been the world's premier jeweler since 1837. The performance of Tiffany's stock is likely to be strongly influenced by the economy. Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) . The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Tiffany's return.  When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

A) −1.98

B) 1.98

C) 4.33

D) 9.58

Correct Answer:

Verified

Q60: If the variance of the error term

Q61: Tiffany & Co. has been the world's

Q62: The accompanying table shows the regression results

Q63: The accompanying table shows the regression results

Q64: A researcher analyzes the factors that may

Q66: A researcher analyzes the factors that may

Q67: Tiffany & Co. has been the world's

Q68: A manager at a local bank analyzed

Q69: A researcher analyzes the factors that may

Q70: A researcher analyzes the factors that may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents