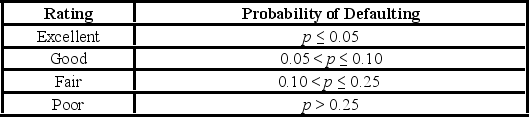

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank. The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability, she decided to use the logit model,

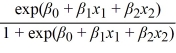

To estimate this probability, she decided to use the logit model,

P =  , where

, where

y = a binary response variable which is 1 if the credit card is in default and 0 otherwise

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

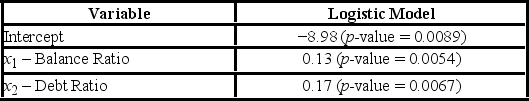

The following output is obtained.  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

(Using Excel or R) Suppose that only applicants with excellent and good ratings are qualified for a loan. Assume that the balance ratio, x1, of those who apply is normally distributed with μ1 = 18% and σ2 = 6%, while their debt ratio, x2, is normally distributed with μ2 = 30% and σ2 = 8%. Assume also that x1 and x2 are independent. Simulate 1,000 applications to estimate the percent of those that are qualified for a loan.

Correct Answer:

Verified

Q120: A realtor wants to predict and compare

Q121: A bank manager is interested in assigning

Q122: A bank manager is interested in assigning

Q123: A bank manager is interested in assigning

Q124: A bank manager is interested in assigning

Q125: A bank manager is interested in assigning

Q126: A bank manager is interested in assigning

Q128: A bank manager is interested in assigning

Q129: A realtor wants to predict and compare

Q130: A bank manager is interested in assigning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents