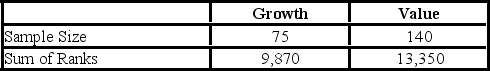

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) . The fund manager collects data on the returns of growth and value funds. Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the p-value approach and α = 0.01, the appropriate conclusion is ________.

Using the p-value approach and α = 0.01, the appropriate conclusion is ________.

A) do not reject the null hypothesis; conclude the median return of growth stock is greater than the median return of value

B) do not reject the null hypothesis; we cannot conclude the median return of growth stock differs from the median return of value stocks

C) reject the null hypothesis; conclude the median return of growth stock is greater than the median return of value stocks

D) reject the null hypothesis; we cannot conclude the median return of growth stock is greater than the median return of value stocks

Correct Answer:

Verified

Q72: A fund manager wants to know if

Q73: A marketing firm needs to replace its

Q74: A marketing firm needs to replace its

Q75: A marketing firm needs to replace its

Q76: A fund manager wants to know if

Q78: A fund manager wants to know if

Q79: A fund manager wants to know if

Q80: A fund manager wants to know if

Q81: A shipping company believes there is a

Q82: A shipping company believes there is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents