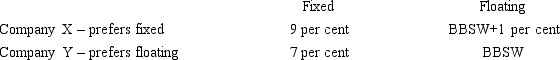

Which strategy below would take advantage of the following comparative advantage?

A) Company X should borrow fixed and Company Y should borrow floating, then they should swap their interest payments.

B) Company X should borrow floating and Company Y should borrow fixed, then they should swap their interest payments.

C) Company X should borrow fixed and Company Y should borrow floating, but there is no benefit to a entering a swap.

D) Company X should borrow floating and Company Y should borrow fixed, but there is no benefit from entering a swap.

E) There is no opportunity for comparative advantage here.

Correct Answer:

Verified

Q52: What are the potential swap savings given

Q53: Which of the following is NOT a

Q54: Suppose the swap rate is 8% and

Q55: Given a normal yield curve, the swap

Q56: A swap arrangement where the floating payment

Q58: Identify the CORRECT statement below regarding an

Q59: In what type of swap contract is

Q60: Swap dealers:

A)charge an up-front fee for arranging

Q61: What type of swap contract played a

Q62: TDK Industries approaches a bank in April

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents