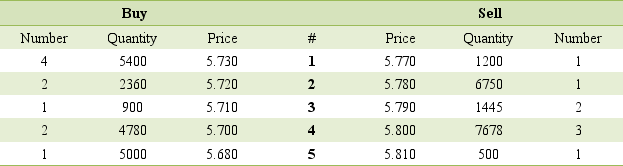

Consider the following market depth information for Fosters Group Ltd:  (a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Identify the INCORRECT statement regarding 'dark pools'.

A)'Crossings'

Q57: The average value of a trade in

Q58: Which of the following is NOT an

Q59: ASX Trade:

A)is the ATS currently used by

Q60: The ASX automated trading system does NOT:

A)facilitate

Q62: Give an overview of the ASX's admission

Q63: List some of the factors for which

Q64: Discuss the trading and settlement arrangements used

Q65: Discuss the role of the share market

Q66: An investment in a CFD contract finishes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents