Adjusting and closing entries

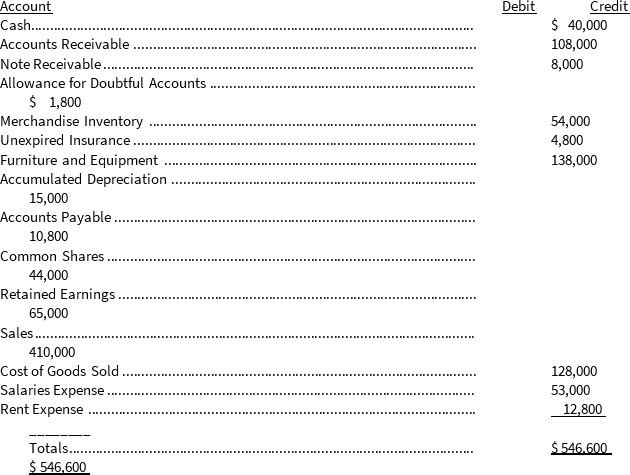

The following trial balance was taken from the books of Kaslo Corporation at December 31, 2020:

At year end, the following items have not yet been recorded.

At year end, the following items have not yet been recorded.

1. Insurance expired during the year, $ 3,000.

2. Estimated bad debts, 1 percent of gross sales.

3. Depreciation on furniture and equipment, 10% per year.

4. Interest at 9% is receivable on the note for one full year.

5. Rent paid in advance at December 31, $ 6,800 (originally debited to expense).

6. Accrued salaries at December 31, $ 6,200.

Instructions

a) Prepare the necessary adjusting entries.

b) Prepare the necessary closing entries.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Adjusting entries

Present, in journal form, the adjustments

Q71: Definitions

Define the following terms:

1. Event

2. Work sheet

3.

Q72: Adjusting entries

Reed Co. wishes to record receipts

Q73: Adjusting and closing entries

1. Using the adjusted

Q74: Calculation of revenue

The records for Oriole

Q76: Which of the following statements about the

Q77: If the inventory account at the end

Q78: Type of ownership structure

Explain whether the

Q79: Calculation of expense

The records for Jay

Q80: Preparing financial statements

The adjusted trial balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents