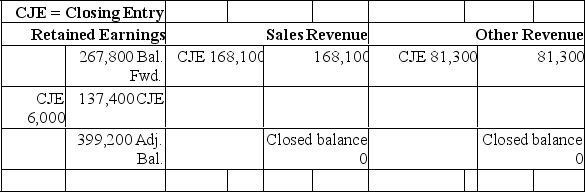

On December 31,2017,Purrfect Pets had retained earnings of $267,800 before making its closing entries.During 2017,the company had sales revenue of $168,100 and other revenue of $81,300.The company sold some investments for a total gain of $24,300.The company used supplies (mainly cat food and litter)during the year that cost $87,900.Administrative expenses were $16,400 and wages (paid in cash)were $18,300.Taxes were $13,700 and dividends declared and paid totalled $6,000.

Prepare T-accounts for the income statement accounts,dividends declared and retained earnings at the end of the year before closing.Then,enter the closing journal entries in the T-accounts and compute the ending balances of the T-accounts.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: At the beginning of the year,net income

Q106: The following data are for the

Q107: Restaurant equipment,which was estimated to last five

Q108: The following data are for the

Q109: Insert the appropriate letter into the

Q111: Harold's House of Hockey (HHH)has owned and

Q112: Brandon Company's annual accounting year ends on

Q113: A business has a corporate income

Q114: $60,000 worth of restaurant equipment,which was estimated

Q115: The sales revenue account has a credit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents