The following information has been adapted from the 2004 and 2005 annual reports of Halliburton Company's worldwide operations, available online at

http://ir.halliburton.com/phoenix.zhtml?c=67605&p=irol-irhome

HALLIBURTON COMPANY

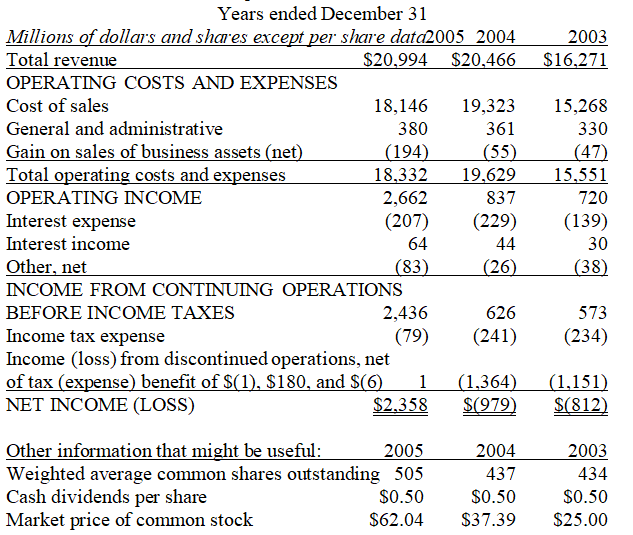

Consolidated Statements of Operations

HALLIBURTON COMPANY

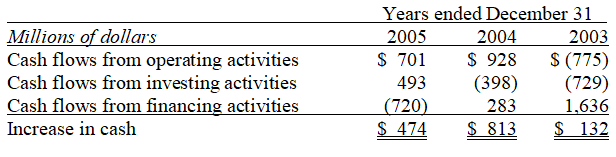

Condensed Consolidated Statements of Cash Flows

HALLIBURTON COMPANY

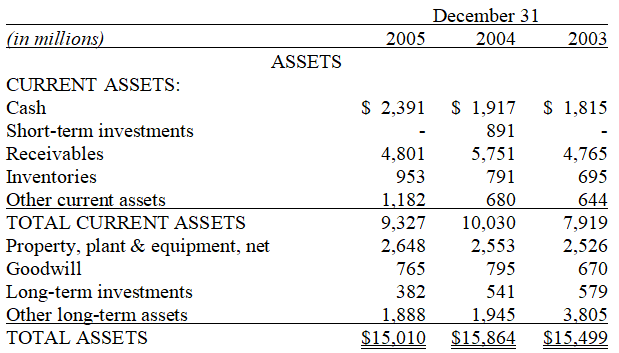

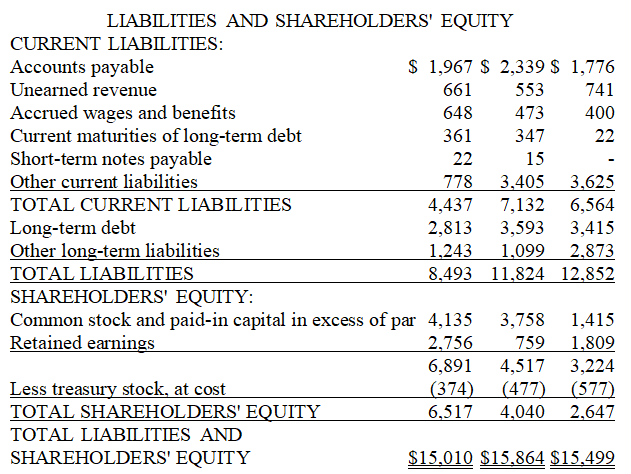

Consolidated Balance Sheets

-Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final,correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

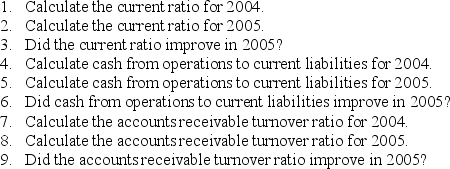

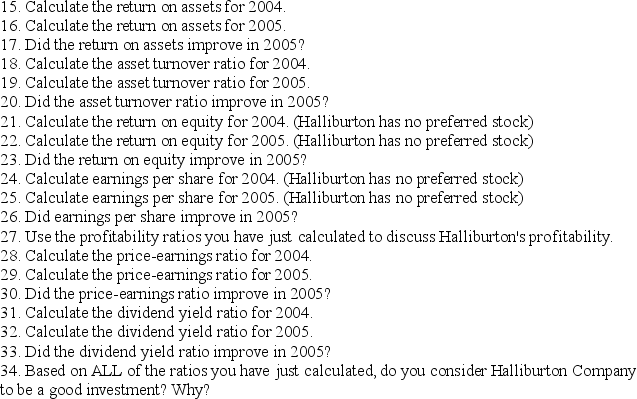

Use the adapted financial statements from Halliburton Company to answer the following questions:

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

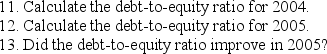

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

Correct Answer:

Verified

2.$9,327 / $4,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q221: Understanding financial accounting helps to minimize the

Q222: Owning bonds as well as stocks is

Q223: The following information has been adapted from

Q224: Indicate which of the following analytical tools

Q225: Indicate which of the following ratios should

Q227: One way to diversify is to _.

A)invest

Q228: Owning only stocks is riskier than owning

Q229: Indicate which of the following analytical tools

Q230: Indicate which of the following ratios are

Q231: The following information has been adapted from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents