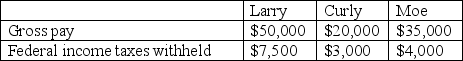

Albert,the accountant,has been asked by his boss to calculate the net pay for each of Pinnock Company's three employees.Albert has gathered the following information about payroll for the period:

Required: Calculate the net pay for each of the employees.Assume that FICA (Social Security)taxes are withheld at the rate of 6.2% of gross pay and that Medicare taxes are withheld at the rate of 1.45% of gross pay.

Required: Calculate the net pay for each of the employees.Assume that FICA (Social Security)taxes are withheld at the rate of 6.2% of gross pay and that Medicare taxes are withheld at the rate of 1.45% of gross pay.

Correct Answer:

Verified

Q47: In May,Fish Nets,Inc.sold 8,000 nets with a

Q48: Identify each of the liabilities listed below

Q49: How should companies estimate and report warranty

Q50: Brooke's Bike Company sold $3,780 worth of

Q51: Warranty expense is recognized when products are

Q53: In May,Fish Nets,Inc.sold 8,000 nets with a

Q54: Companies are required to recognize warranty expense

Q55: In November,Mayberry Repair Shop spent $395 on

Q56: Explain how payroll affects the liabilities of

Q57: WhackCo began business on January 1,2011.Show the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents