Payless,Inc's gross payroll was $100,000 for the current pay period.Federal income tax (FIT)withheld totals $20,000.The FICA (Social Security)rate is 6.2% and the Medicare rate is 1.45%.

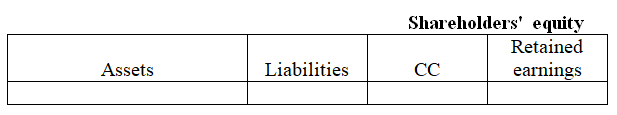

Part A: Show the effect of paying its employees (do not record the employer’s payroll taxes):

Part B: How much cash will Payless,Inc.have to pay to the government for Federal income taxes,Social Security,and Medicare on the gross payroll of $100,000?

Correct Answer:

Verified

Part B: ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: Indicate with an "X" whether each description

Q40: An employee's gross pay is recorded as

Q41: The following data comes from the payroll

Q42: Brook's Bike Company sold 80 mountain bikes

Q43: Brooke's Bike Company sold 225 mountain bikes

Q45: When companies borrow money for longer than

Q46: Matt's Rug Company began business on January

Q47: In May,Fish Nets,Inc.sold 8,000 nets with a

Q48: Identify each of the liabilities listed below

Q49: How should companies estimate and report warranty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents