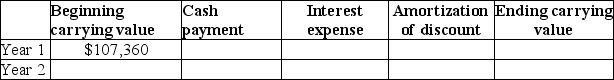

Team Shirts issued 10-year bonds with a face value of $100,000.The bonds carry a 7% stated interest rate and pay interest once a year.They were issued when the market interest rate was 6% and sold for $107,360.

Required:

a.Complete the amortization schedule for the first two years of the bond issue using the effective interest method.Round to the nearest dollar.

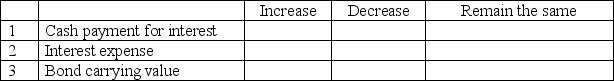

b.Put an X in the appropriate box to describe how each of these items will behave with each additional interest payment:

b.Put an X in the appropriate box to describe how each of these items will behave with each additional interest payment:

c.Fill in the correct dollar amounts:

c.Fill in the correct dollar amounts:

At maturity,after the last interest payment has been made,the unamortized premium on the bonds will be $______________ and the carrying value of the bonds will be $_______________.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q189: On October 31,2011,Bondable,Inc.issued $20,000 of 10-year,6% bonds

Q190: On January 1,2011,Dew Drop Inn borrowed $80,000

Q191: On October 31,2011,Bondable,Inc.issued $20,000 of 10-year,6% bonds

Q192: Borrowing cash is _ activity.

A)an operating

B)an investing

C)a

Q193: On January 1,2011,Dew Drop Inn borrowed $80,000

Q195: On June 1,2011,Par for the Course,Inc.purchased building

Q196: On January 1,2011,Sea the World Cruises,Inc.issued $100,000

Q197: Show the effect on the accounting equation

Q198: On June 1,2011,Par for the Course,Inc.purchased building

Q199: On January 1,2011,Nadir Company issued $1,000,000 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents