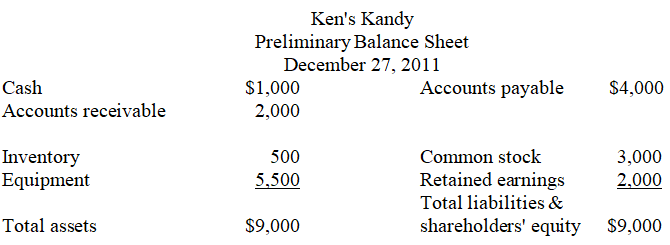

Ken's Kandy prepared the following preliminary balance sheet a few days before its December 31 yearend: Ken is concerned about the size of the accounts payable in relation to the company's cash and other current assets.He asks the accountant to reclassify $3,000 of the accounts payable as long-term notes payable before releasing the annual report on December 31.

Ken is concerned about the size of the accounts payable in relation to the company's cash and other current assets.He asks the accountant to reclassify $3,000 of the accounts payable as long-term notes payable before releasing the annual report on December 31.

a.What is the company's current ratio now,based on the preliminary balance sheet?

The formula for calculating the current ratio is current assets / current liabilities.

b.What will the company's current ratio be if $3,000 of the accounts payable are reclassified as long-term notes payable?

c.Will reclassifying the accounts payable have any effect on the debt-to-equity ratio? Explain.

d.Is it ethical to reclassify current liabilities as long-term liabilities,as long as total liabilities are correct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q234: Maxine's Equipment Company had $400,000 in total

Q235: Team instructions: Provide students with copies of

Q236: The primary risk associated with long-term debt

Q237: Risks associated with debt affect both a

Q238: Z Best,Inc.sold a 5-year,$1,000,zero-interest bond for $497.18

Q240: Discounting means _.

A)selling bonds for less than

Q241: The higher the debt-to-equity ratio the greater

Q242: Gary's Gadgets prepared the following preliminary balance

Q243: The risk associated with debt is risk

Q244: Team instructions: Provide students with copies of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents