On January 1,2012,Orbit,Inc.purchased land and a building for a total of $90,000 by paying $20,000 cash and issuing a note for the rest.The market value of the building was appraised at $80,000 and the land at $20,000.Write in both the correct dollar amounts and the account titles involved.Use a plus for increases and parentheses ()for decreases.

Part A: Show the effect of the purchase on the accounting equation.

Part B: Show the effect of the first year's depreciation,assuming the straight-line method and an estimated useful life of 20 years with a $32,000 salvage value.

Part B: Show the effect of the first year's depreciation,assuming the straight-line method and an estimated useful life of 20 years with a $32,000 salvage value.

Part C: Show the effect of the first year's depreciation,assuming double-declining depreciation and an estimated useful life of 20 years with a $32,000 salvage value.

Part C: Show the effect of the first year's depreciation,assuming double-declining depreciation and an estimated useful life of 20 years with a $32,000 salvage value.

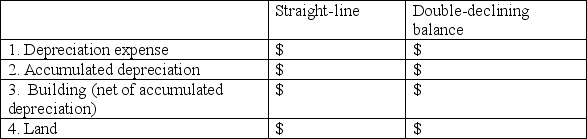

Part D: Show the amounts that would appear on the annual financial statements at the end of the THIRD YEAR for each method.

Part D: Show the amounts that would appear on the annual financial statements at the end of the THIRD YEAR for each method.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: On January 1,2011,Ace Electronics paid $400,000 cash

Q59: On January 1,2011,Ace Electronics paid $400,000 cash

Q60: On January 1,2011,Ace Electronics paid $400,000 cash

Q61: Capitalizing a cost means to record the

Q62: The TOTAL amount of depreciation recorded over

Q64: To "capitalize" means to record a cost

Q65: Peterson Company purchased land,building,and equipment for a

Q66: In an accounting context,cost and expense mean

Q67: Cost means the cash or cash equivalent

Q68: SML International owns an oil field that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents