On January 1 2010,Max,Inc.paid $80,000 for a truck with an estimated useful life of 10 years and a $20,000 salvage value.During 2013,Max,Inc.'s truck was not running very well.

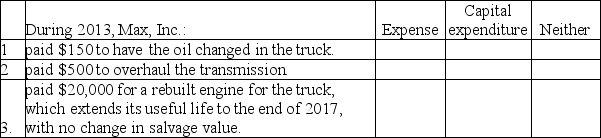

Part A: Put an X in the appropriate box to show whether each item is an expense,a capital expenditure,or neither.

Part B:

1.Straight-line depreciation expense for 2012 is

$_____________________.

2.The book value of the machine at December 31,2012 is $___________________.

3.Straight-line depreciation expense for 2013,after the major overhaul,is $__________.

Correct Answer:

Verified

Part B:

1....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Identify the appropriate accounting treatment for each

Q105: A loss on the sale of a

Q106: DFS Company sold an asset for $8,500

Q107: A loss is a _.

A)reduction in liabilities

B)reduction

Q108: Put an X in the appropriate box

Q110: David Justice Company incurred the following expenditures

Q111: Able Company bought a machine on January

Q112: Required: Put an X in the appropriate

Q113: Explain when a cost should be recorded

Q114: Identify the appropriate accounting treatment for each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents