On January 1, 2011, Muddy Acres, Inc. purchased a $44,000 mulching machine with a useful life of 5 years and a $4,000 salvage value. The company uses straight-line depreciation. On December 31, 2014, after 4 full years of use, Muddy Acres sold the machine for $6,000.

Part A: Show the effect of the sale in 2014 on the accounting equation. Write in both the correct dollar amounts and the account titles affected. Use a + for increases and parentheses () for decreases. Assume that depreciation expense for 2014 has already been recorded.

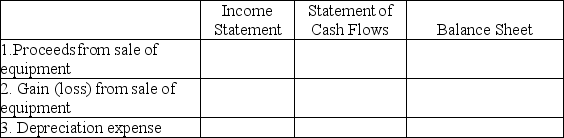

Part B: For each item below,WRITE IN THE AMOUNT as of or for the period ended December 31,2014,in the column of the one financial statement where the amount is found.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Indicate whether each of the following transactions

Q125: A machine was purchased for $100,000 in

Q126: A machine was purchased for $100,000 in

Q127: A loss results when a long-term asset

Q128: Indicate whether each of the following transactions

Q130: What is book value and on which

Q131: A machine was purchased for $100,000 in

Q132: On January 1,2011,Fred McGriff Company bought office

Q133: Eta Co.experienced the following events during the

Q134: A machine was purchased for $100,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents