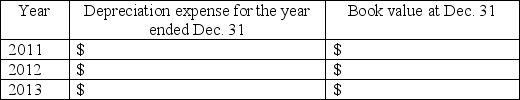

On January 1,2011,Gamma Company purchased equipment that cost $30,000.The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000.

Required:

1.Use the double-declining balance method to complete the chart below:

2.Explain why long-term assets must be depreciated.

2.Explain why long-term assets must be depreciated.

3.Explain why land is NOT depreciated when assets like equipment are.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q163: On January 1,2011,XYZ Company bought a new,$2,000,000

Q164: Indicate which financial statement would report the

Q165: KenCo bought a new packaging machine on

Q166: On February 1, 2011, Delta Distribution Company

Q167: On January 1, 2011, Keep Trucking, Inc.

Q169: A client has asked you to review

Q170: On January 1,2011,Crunch Company paid $100,000 for

Q171: Use the following selected information from PDG

Q172: Robin Blind,Inc.recorded the following entries during the

Q173: On January 1,2011.Hula Hoops,Inc.purchased a $40,000 machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents