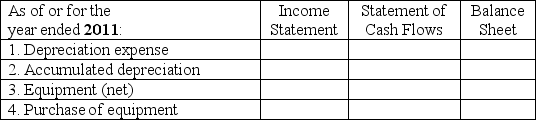

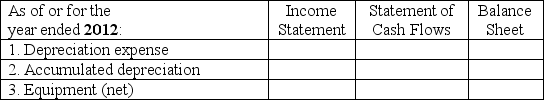

On January 1,2011.Hula Hoops,Inc.purchased a $40,000 machine for cash.The company uses straight-line depreciation,an estimated useful life of 5 years,and a $2,000 salvage value.

Treat each of the following scenarios independently.For each,write in the amount in the column that represents the one financial statement where the amount is found.Round your answers to the nearest whole dollar.The company's yearend is December 31.

Part A: On December 31,2011,the company was told by an appraiser that the machine is in such great condition it could be sold for $38,000.

Part B: In December 2012,the company decided that the machine's original estimated useful life of 5 years should be revised to a total of 8 years since the machine is in such good condition.Salvage value is still $2,000.

Part B: In December 2012,the company decided that the machine's original estimated useful life of 5 years should be revised to a total of 8 years since the machine is in such good condition.Salvage value is still $2,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q168: On January 1,2011,Gamma Company purchased equipment that

Q169: A client has asked you to review

Q170: On January 1,2011,Crunch Company paid $100,000 for

Q171: Use the following selected information from PDG

Q172: Robin Blind,Inc.recorded the following entries during the

Q174: A client has asked you to review

Q175: Identify each of the assets listed below

Q176: Use the following selected information from XYZ

Q177: Use the following selected information from XYZ

Q178: Use the following selected information from PDG

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents