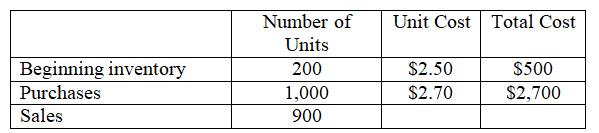

The following information is from the accounting records of JackCo:

Required:

1. Determine the cost of goods sold assuming JackCo uses the first-in, first-out (FIFO) inventory method.

2. Determine the cost of goods sold assuming JackCo uses the last-in, first-out (LIFO) inventory method.

3. Which inventory method results in LOWER taxable income for the period? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: On June 1,beginning inventory consists of ten

Q114: Philipsburg Corporation sells mugs to fine retailers

Q115: Grand Forks Enterprises sells toy airplanes to

Q116: Fargo Engines Incorporated sells part number 45G

Q117: The cost flow method a firm uses

Q119: LIFO is the cost flow method that

Q120: In a time of rising prices,the main

Q121: In times of rising prices,a company that

Q122: In a period of rising inventory costs,the

Q123: IFRS require publicly-traded corporations to use _.

A)the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents