Gnu Company began business January 1,2011.The company has a liberal credit policy and has been experiencing a high rate of uncollectible accounts.Due to the significance of this amount,the company uses the allowance method for accounting for bad debts.During 2011,credit sales were $400,000.The year-end accounts receivable balance was $170,000.

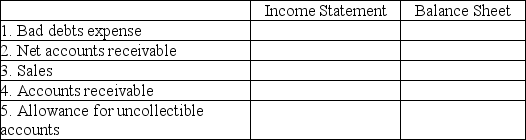

Part A: Assume that the company uses the sales method and estimates that 5% of credit sales will become bad debts.Select the column which represents the financial statement where the item will appear,and fill in the correct dollar amount:

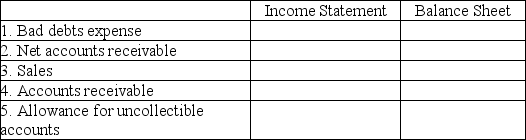

Part B: Now assume that the company uses the accounts receivable method and estimates that 10% of accounts receivable will be uncollectible.Select the column which represents the financial statement where the item will appear,and fill in the correct dollar amount:

Part B: Now assume that the company uses the accounts receivable method and estimates that 10% of accounts receivable will be uncollectible.Select the column which represents the financial statement where the item will appear,and fill in the correct dollar amount:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Discuss the importance of reporting net accounts

Q101: Part A: Justin Company has accounts receivable

Q102: Timmy's Tires sold $18,750 worth of tires

Q103: Since C.D.Lee's bonus is tied to net

Q104: Sally has a new VISA card that

Q106: On July 31,the accountant for Team Shirts

Q107: Team Instructions: Divide the class into teams

Q108: On June 30,the accountant for Team Shirts

Q109: Credit card sales benefit companies because _.

A)the

Q110: Brooke's Bikes sold $11,235 worth of mountain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents