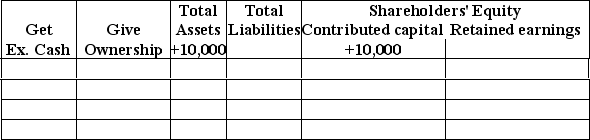

Morris Lest began his business,Graters,Inc.with $10,000 of his savings.Graters borrowed $5,000 from Baroque Bank.Graters bought $3,000 worth of graters.The rent for the store is $1,000 per month.The first month's sales were $4,000 for inventory valued at $2,500.All of the transactions were in cash.Identify the get/give transactions above,and determine if there is an increase or decrease in assets,liabilities,or shareholders' equity.

Correct Answer:

Verified

Q70: A person who starts his own business

Q71: A sole proprietorship has more than one

Q72: Transactions can only occur between businesses.

Q73: Indicate the form of organization with which

Q74: Identify and describe the three types of

Q76: The Sarbanes-Oxley Act of 2002 required a

Q77: Audited financial statements have been examined by

Q78: Team Shirts,Inc.pays $600 for insurance.This transaction _.

A)causes

Q79: All liabilities represent the costs incurred to

Q80: To be useful,information must be accurate and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents