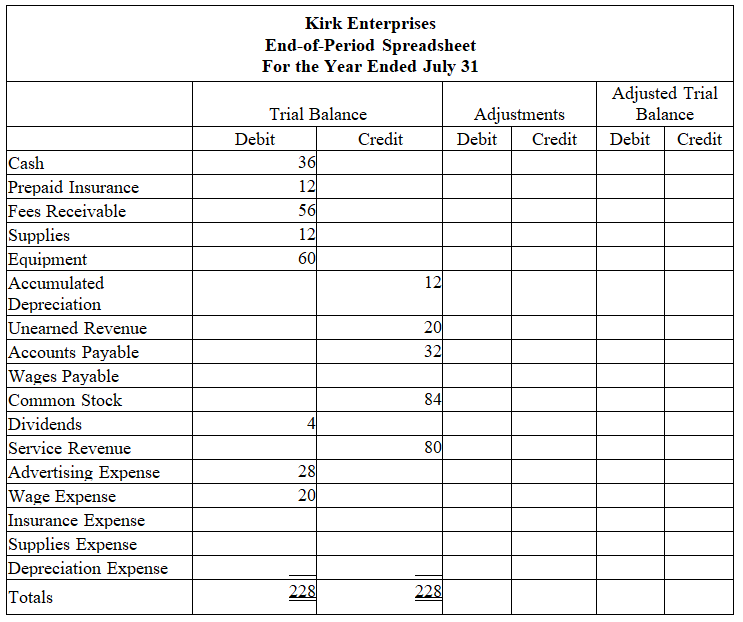

Kirk Enterprises offers rug cleaning services to business clients.Below is the adjustments data for the year ended July 31.Using this information along with the spreadsheet below,record the adjusting entries in proper general journal form.

Adjustments:

a The equipment is estimated to last for 5 years with no salvage value.The asset will be depreciated evenly over its useful life.Record one month's depreciation.

b Accrued wages,$2.

c Unused supplies on hand,$8.

d Of the unearned revenue,75% has been earned.

e Unexpired insurance remaining at the end of the month,$9.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q164: After all adjustments have been made,but

Q165: On the basis of the following information

Q168: The following adjusted trial balance is the

Q170: Indicate whether each of the following would

Q173: Kirk Enterprises offers rug cleaning services to

Q174: Prepare closing entries from the following end-of-period

Q181: If end-of-period spreadsheets are not considered part

Q189: Prior to adjustment at August 31, Salary

Q199: List and describe the purpose of the

Q208: Explain how net income or loss is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents