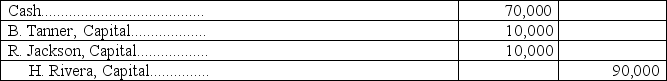

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A) Acceptance of a new partner who invests $70,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Tanner and Jackson.

E) Withdrawal of $10,000 each by Tanner and Jackson upon the admission of a new partner.

Correct Answer:

Verified

Q70: When a partnership is liquidated,which of the

Q74: A capital deficiency means that:

A) The partnership

Q77: Rodriguez, Sate, and Melton are dissolving their

Q78: McCartney, Harris, and Hussin are dissolving their

Q80: Force and Zabala are partners.Force's capital balance

Q81: Identify and discuss the key characteristics of

Q97: Sierra and Jenson formed a partnership. Sierra

Q102: Khalid,Dina,and James are partners with beginning-year capital

Q129: Define the partner return on equity ratio

Q133: What are the ways a partner can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents