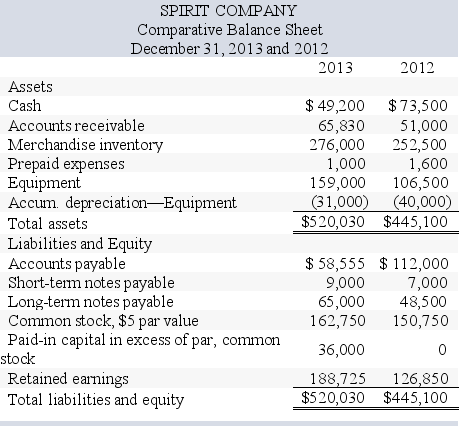

Spirit Company,a merchandiser,recently completed the 2013 calendar year.For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory,and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.The company's balance sheet and income statement follow:

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

Additional information on year 2013 transactions:

a.The loss on the cash sale of equipment was $5,875 (details in b).

b.Sold equipment costing $46,500, for a loss of $5,875.

c.Purchased equipment costing $99,000 by paying $35,000 cash and signing a long-term note payable for the balance.

d.Borrowed $2,000 cash by signing a non-sales related short-term note payable.

e.Paid $47,500 cash to reduce the long-term notes payable.

f.Issued 2,400 shares of common stock for $20 cash per share.

g.Net income and dividends were the only items that affected retained earnings.

-Required: Compute the net cash flows provided (used) by investing activities.

A.($23,375)

B.$23,375

C.$46,500

D.($35,000)

E.$35,000

Correct Answer:

Verified

Asset sold: Beg.accumulated dep.$40,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: Walker Company reports net income of $420,000

Q113: When analyzing the changes on a spreadsheet

Q114: When analyzing the changes on a spreadsheet

Q115: A corporation prepares its statement of cash

Q116: A company had cost of goods sold

Q118: Selected information from Jet Company's 2013 financial

Q119: Selected information from Jet Company's 2013 financial

Q120: Explain how to determine cash flows from

Q122: A corporation reported average total assets of

Q194: Describe the format of the statement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents