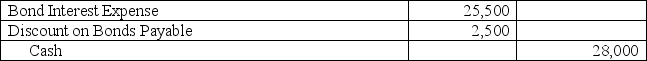

On January 1,2013,a company issued and sold an $850,000,6%,five-year bond payable and received proceeds of $825,000.Interest is payable each June 30 and December 31.The company uses the straight-line method to amortize the discount.The journal entry to record the first interest payment is:

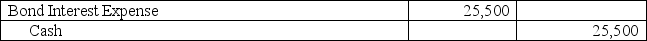

A)

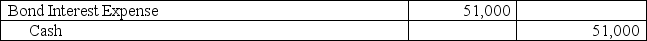

B)

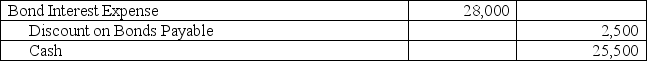

C)

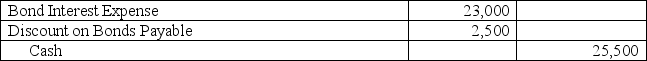

D)

E)

Correct Answer:

Verified

Q70: A company issued five-year,7% bonds with a

Q74: A company issued 10%,five-year bonds with a

Q76: A company issued five-year,7% bonds with a

Q77: A company issued 8%,15-year bonds with a

Q78: A company issued 25-year,8% bonds with a

Q79: A company issued seven-year,8% bonds with a

Q80: The Premium on Bonds Payable account is

Q92: A company received cash proceeds of $206,948

Q96: A discount on bonds payable:

A) Occurs when

Q99: The market value of a bond is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents