On January 1,2013,Jacob issued $600,000 of 11%,15-year bonds at a price of 102½.The straight-line method is used to amortize any bond discount or premium and interest is paid semiannually.All interest has been accounted for (and paid) through December 31,2018.The company retires 30% of these bonds by buying them on the open market at 98½. What is the journal entry to record the retirement of 30% of the bonds on January 1,2019?

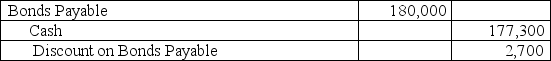

A)

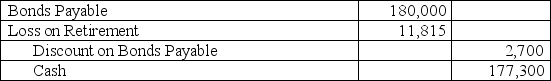

B)

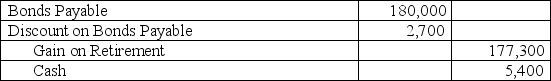

C)

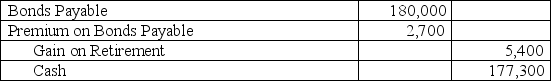

D)

E)

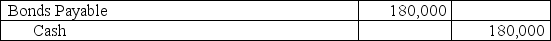

Correct Answer:

Verified

Q80: The Premium on Bonds Payable account is

Q81: On January 1,2013,Jacob issues $600,000 of 11%,15-year

Q82: On January 1,2013,Jacob issues $800,000 of 9%,13-year

Q83: A company retires its bonds at 105.The

Q84: On April 1,2013,Jared Enterprises issues bonds dated

Q86: On October 1,a $30,000,6%,three-year installment note payable

Q87: On January 1,2013,Jacob issues $600,000 of 11%,15-year

Q89: A company has bonds outstanding with a

Q90: On January 1,2013,Jacob issues $800,000 of 9%,13-year

Q95: A company has bonds outstanding with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents