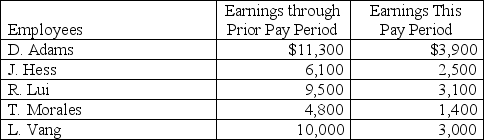

A company's employees had the following earnings records at the close of the current payroll period:

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $110,100 (for 2012) plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $110,100 (for 2012) plus 1.45% FICA Medicare on all wages; 0.8% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q144: Pastimes Co. offers its employees a bonus

Q170: _ allowances are items that reduce the

Q174: A company's payroll information for the month

Q175: Cooper Company borrows $785,100 cash on November

Q176: If Jefferson Company paid a bonus equal

Q178: Apple Company has three employees:

Q180: The payroll records of a company provided

Q187: A _ is a written promise to

Q190: Gross pay less all deductions is called

Q205: To compute the amount of tax withheld

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents