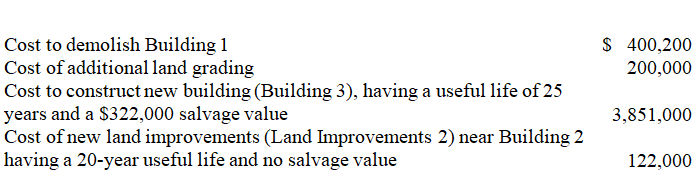

Giant Green Company pays $3,000,000 for a tract of land with two buildings on it.It plans to demolish Building 1 and build a new store in its place.Building 2 will be a company office; it is appraised at $742,000,with a useful life of 25 years and a $75,000 salvage value.A lighted parking lot near Building 1 has improvements (Land Improvements 1) valued at $400,500 that are expected to last another 18 years with no salvage value.Without the buildings and improvements,the tract of land is valued at $2,020,600.Giant Green also incurs the following additional costs:

-What is the amount that should be recorded for the tract of land?

A) $2,516,600

B) $2,020,600

C) $3,851,000

D) $1,916,400

E) $3,000,000

Correct Answer:

Verified

Q101: Furniture costing $10,000 with accumulated depreciation of

Q102: Smitty Museum purchased the copyright to a

Q103: Abbott Industries operates a mineral deposit with

Q104: On December 31,2013,Stable Company sold a piece

Q105: Perry Trucking has its local automotive service

Q107: Clark Street Company purchases $50,000 in new

Q108: Valley Inc.purchases a patent costing $45,000 with

Q109: On September 1,2014,Drill Far Company purchased a

Q110: A company purchased equipment for $5,000 on

Q111: A company purchased equipment valued at $200,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents