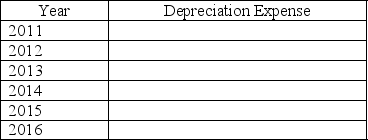

The Weiss Company purchased a truck for $95,000 on January 2,2011.The truck was estimated to have a $3,000 salvage value and a four-year life.The truck was depreciated using the straight-line method.During 2013,it was obvious that the truck's total useful life would be six years rather than four and the salvage at the end of the sixth year would be $1,500.Determine the depreciation expense for the truck for the six years of its life.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Compare the different depreciation methods (straight-line, units-of-production,

Q128: What is depreciation of plant assets?

What

Q139: A company purchased a heating system on

Q140: A company had net sales of $789,765

Q143: A company entered into the following transactions

Q144: A company purchased equipment valued at $825,000

Q145: On April 1,2012,SAS Corp.purchased and placed in

Q146: A company purchased a special purpose machine

Q173: A company had net sales of $230,000

Q190: Explain the difference between revenue expenditures and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents