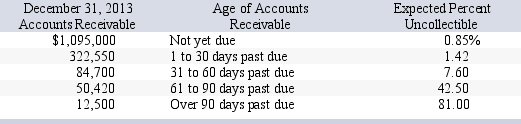

Chiller Company has credit sales of $5.60 million for year 2013.Chiller estimates that 1.32% of the credit sales will not be collected.Historically,4% of outstanding accounts receivable is uncollectible.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $3,561.Chiller prepares a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the percent of sales method,

Assuming the company uses the percent of sales method,

-What is the amount that Chiller will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

A) $55,439.41

B) $73,920.00

C) $48,317.41

D) $70,359.00

E) $66,167.80

Correct Answer:

Verified

Q107: Crystal Products allows customers to use bank

Q111: Chiller Company has credit sales of $5.60

Q112: Broadway Inc.uses the direct write-off method.Previously,the company

Q113: On November 15,2013,Betty Corporation accepted a note

Q114: Chiller Company has credit sales of $5.60

Q115: Chiller Company has credit sales of $5.60

Q117: Halsted Inc.uses the allowance method.Previously,the company had

Q118: Acme Company has credit sales of $3.10

Q118: How are the direct write-off method and

Q119: Tecom accepts the NOVA credit card for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents