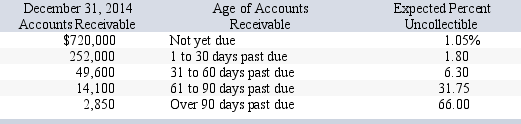

Corona Company has credit sales of $4.60 million for year 2014.The company estimates that 2% of sales will be uncollectible.On December 31,2014,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $13,164.Corona prepares a schedule of its December 31,2014,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:

Assuming the company used the percent of sales method determine the amount that should be recorded for bad debt expense on December 31,2014.

Assuming the company used the percent of sales method determine the amount that should be recorded for bad debt expense on December 31,2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Cairo Co. uses the allowance method of

Q137: A company reports the following results in

Q138: Explain the basic differences between estimating the

Q139: Corona Company has credit sales of $4.60

Q140: A company had the following items and

Q141: The following series of transactions occurred during

Q143: The Connecting Company uses the percent of

Q144: Timmons Company had a January 1 credit

Q146: Prepare general journal entries for the following

Q147: Assume that this company's bad debts are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents