After preparing an (unadjusted) trial balance at year-end, G. Chu of Chu Design Company discovered the following errors:

1.Cash payment of the $225 telephone bill for December was recorded twice.

2.Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes

Payable for $1,000.

3.A $900 cash dividend was recorded to the correct accounts as $90.

4.An additional investment of $5,000 cash by the owner was recorded as a debit to Common

Stock and a credit to Cash.

5.A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

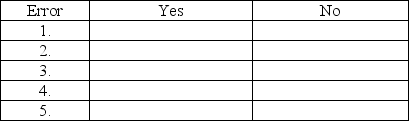

Using the form below,indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q146: Flora Accounting Services completed these transactions in

Q162: Montgomery Marketing Co. had assets of $475,000;

Q186: A company paid $2,500 cash to satisfy

Q187: Josephine's Bakery had the following assets and

Q188: The balances for the accounts of Mike's

Q190: Maria Sanchez began business as Sanchez Law

Q193: A business paid a $100 cash dividend.Assume

Q194: On October 1,2011,Smith invested $20,000 cash,office equipment

Q195: Josephine's Bakery had the following assets and

Q196: Michael Jansen starts a business called Crafty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents