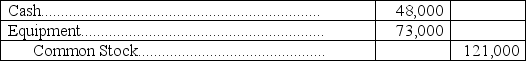

S.Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership.The journal entry to record the transaction for the partnership is:

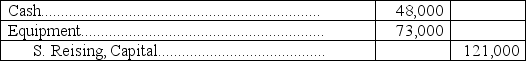

A)

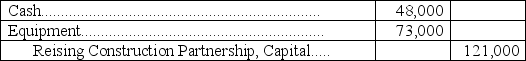

B)

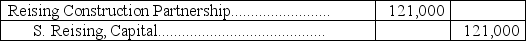

C)

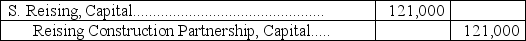

D)

E)

Correct Answer:

Verified

Q41: If a partnership contract provides for interest

Q42: Rice,Hepburn and DiMarco formed a partnership with

Q43: Miller and Reising formed a partnership.Miller contributed

Q44: Elaine Valero is a limited partner in

Q47: Collins and Farina are forming a partnership.Collins

Q48: S.Reising contributed $48,000 in cash plus equipment

Q49: Chad Forrester is a limited partner in

Q50: Blaser,Lukins,and Franko formed a partnership with Blaser

Q52: Collins and Farina are forming a partnership.

Q59: Partnership accounting:

A) Is the same as accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents