Rodriguez,Sate,and Melton are dissolving their partnership.Their partnership agreement allocates income and losses equally among the partners.The current period's ending capital account balances are Rodriguez,$30,000; Sate,$30,000; and Melton,$(4,000) .After all the assets are sold and liabilities are paid,but before any contributions are considered to cover any deficiencies,there is $56,000 in cash to be distributed.Melton pays $4,000 to cover the deficiency in her account.The general journal entry to record the final distribution would be:

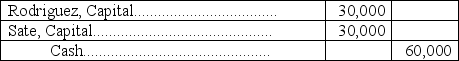

A)

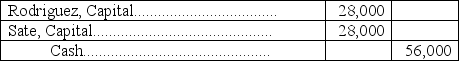

B)

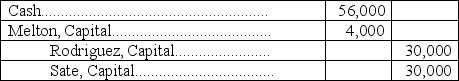

C)

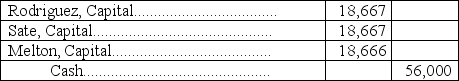

D)

E)

Correct Answer:

Verified

Q61: Shelby and Mortonson formed a partnership with

Q62: When a partner is added to a

Q63: Force and Zabala are partners.Force's capital balance

Q64: Groh and Jackson are partners.Groh's capital balance

Q65: McCartney,Harris,and Hussin are dissolving their partnership.Their partnership

Q67: Brown and Rubix are partners.Brown's capital balance

Q68: During 2013,Schmidt invested $75,000 and Baldwin invested

Q69: McCartney,Harris,and Hussin are dissolving their partnership.Their partnership

Q70: When a partnership is liquidated,which of the

Q71: Groh and Jackson are partners.Groh's capital balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents