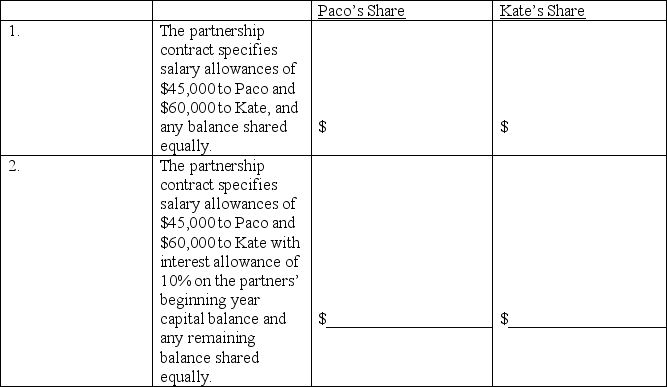

Paco and Kate invested $99,000 and $126,000,respectively,in a partnership they began one year ago.Assuming the partnership earned $120,000 during the current year,compute the share of the net income each partner should receive under each of these independent assumptions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Khalid,Dina,and James are partners with beginning-year capital

Q104: Holden,Phillips,and Rogers are partners with beginning-year capital

Q104: Juanita invested $100,000 and Jacque invested $95,000

Q107: Armstrong plans to leave the FAP Partnership.The

Q108: Armstrong plans to leave the FAP Partnership.The

Q114: The BlueFin Partnership agrees to dissolve. The

Q115: Conley and Liu allow Lepley to purchase

Q119: Marquis and Bose agree to accept Sherman

Q143: A _ is an unincorporated association of

Q155: The life of a partnership is _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents