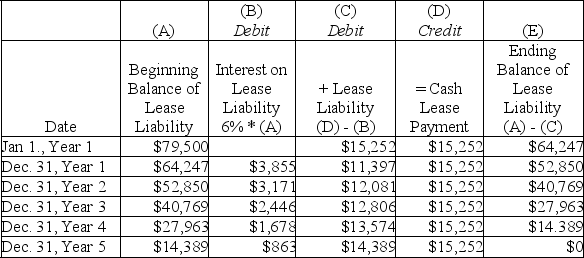

On January 1,Haymark Corporation signs a six-year lease for a truck that is accounted for as a finance lease.The lease requires six $15,252 lease payments (the first at the beginning of the lease and the rest at December 31 of years 1 through 5).The present value of the six annual lease payments,at 6% interest,is $79,500.The lease payment schedule follows.

(a)Prepare the January 1 journal entry at the start of the lease to record any asset or liability.

(a)Prepare the January 1 journal entry at the start of the lease to record any asset or liability.

(b)Prepare the January 1 journal entry to record the first $15,252 cash lease payment.

(b)Prepare the journal entry to record the cash lease payment at the end of Year 1 and the end of Year 2.

(c)Prepare the journal entry made at the end of each year to record straight-line amortization,assuming zero salvage value at the end of the six-year lease term.

Correct Answer:

Verified

Q184: A company issued 10-year, 9% bonds with

Q185: Johanna Corporation issued $3,000,000 of 8%, 20-year

Q187: A company enters into an agreement to

Q188: A company issued 9.2%, 10-year bonds with

Q189: A company issued 10-year, 9% bonds with

Q189: On January 1,a company issues 8%,5-year,$300,000 bonds

Q190: On July 1 of the current year

Q191: A company issued 10-year, 9% bonds, with

Q192: A company issued 9%, 10-year bonds with

Q200: Sharma Company's balance sheet reflects total assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents