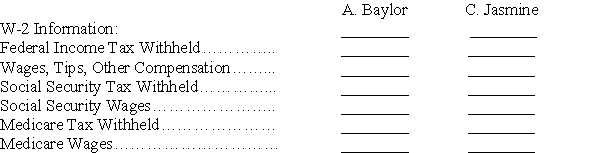

A company's employer payroll tax rates are 0.6% for federal unemployment taxes,5.4% for state unemployment taxes,6.2% for FICA social security taxes on earnings up to $128,400,and 1.45% for FICA Medicare taxes on all earnings.Compute the W-2 Wage and Tax Statement information required below for the following employees:

Correct Answer:

Verified

Q113: A company sells sofas with a 6-month

Q129: Star Recreation receives $48,000 cash in advance

Q190: Gross pay less all deductions is called

Q193: Richardson Fields receives $31,680 cash in advance

Q194: Santa Barbara Express has 4 sales employees,each

Q196: A company's employees had the following earnings

Q196: A _ shows the pay period dates,

Q198: On January 31,Ransom Company's payroll register showed

Q202: Vacation benefits are a type of

Q203: A _ is a seller's obligation to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents