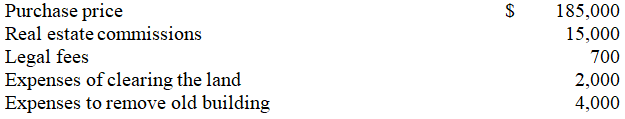

Merchant Company purchased property for a building site.The costs associated with the property were:

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $187,700 to Land; $19,000 to Building.

B) $200,700 to Land; $6,000 to Building.

C) $200,000 to Land; $6,700 to Building.

D) $185,000 to Land; $21,700 to Building.

E) $206,700 to Land; $0 to Building.

Correct Answer:

Verified

Q6: The straight-line depreciation method and the double-declining-balance

Q21: Marlow Company purchased a point of sale

Q22: The depreciation method that produces larger depreciation

Q23: Which of the following is not classified

Q24: A company purchased property for $100,000.The property

Q32: The calculation of total asset turnover is:

A)Gross

Q36: The formula to compute annual straight-line depreciation

Q39: Spears Co.had net sales of $35,400 million.Its

Q58: A company purchased a weaving machine for

Q72: A total asset turnover ratio of 3.5

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents