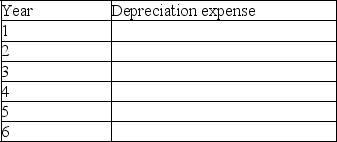

The Oberon Company purchased a delivery truck for $95,000 on January 2.The truck was estimated to have a $3,000 salvage value and a 4 year life.The truck was depreciated using the straight-line method.At the beginning of the third year,it was determined the truck's total useful life would be 6 years rather than 4,and the salvage at the end of the 6th year would be $1,500.Determine the depreciation expense for the truck for the 6 years of its life.

Correct Answer:

Verified

Year 1-Year 2 depreciatio...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: On January 1,2016,a company disposed of equipment

Q126: A company purchased land with a building

Q205: A company needed a new building.It found

Q207: A company purchased a special purpose machine

Q208: A company had net sales of $1,540,500

Q209: In year one,McClintock Co.acquired a truck that

Q211: A company paid $595,000 for property that

Q214: A company had net sales of $230,000

Q215: McClintock Co.had the following transactions involving plant

Q217: A company purchased a cooling system on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents