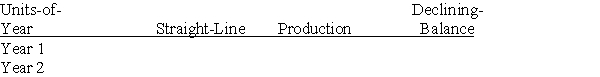

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Double

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: On July 1 of the current year,Glover

Q221: Additional costs of plant assets that do

Q224: The depreciation method that charges a varying

Q231: The depreciation method that uses a depreciation

Q241: _are capital expenditures that make a

Q242: Revenue expenditures to keep an asset in

Q243: Identify the balance sheet classification of each

Q244: _ is an estimate of an asset's

Q245: On July 1 of the current year,Timberlake

Q249: Westport Company reports the following in millions:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents