Following are seven items a through g that would cause Rembrandt Company's book balance of cash to differ from its bank statement balance of cash.

a.A service charge imposed by the bank.

b.A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c.A customer's check returned by the bank is marked "Not Sufficient Funds (NSF)".

d.A deposit mailed to the bank on the last day of the current month and not recorded on this month's bank statement.

e.A check paid by the bank at its correct $190 amount recorded in error in the company's check register at $109.

f.The bank collected a note receivable for Rembrandt Company and deposited the proceeds in the company's account.At period end,Rembrandt had yet to record this deposit.

g.A check written in the current period that is not yet paid or returned by the bank.

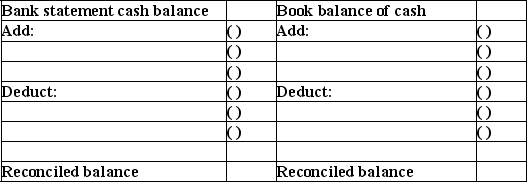

Indicate where each item,letters a-g,would appear on Rembrandt Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Correct Answer:

Verified

Q157: Identify each of the following items 1

Q159: For each of the independent cases below,identify

Q161: A petty cash fund was originally established

Q162: At the end of the current period,

Q163: Describe the use and purpose of purchase

Q163: The treasurer of a company is responsible

Q164: On March 1, a company established a

Q164: A company established a petty cash fund

Q166: Norman Co. had $5,925 million in sales

Q167: A company reported net sales for Year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents