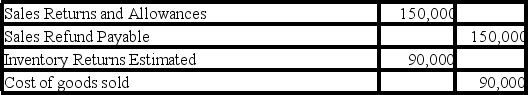

In the current year,Borden Corporation had sales of $2,000,000 and cost of goods sold of $1,200,000.Borden expects returns in the following year to equal 8% of sales.The unadjusted balance in Inventory Returns Estimated is a debit of $6,000,and the unadjusted balance in Sales Refund Payable is a credit of $10,000.The adjusting entry or entries to record the expected sales returns is (are) :

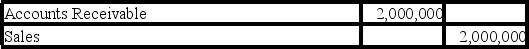

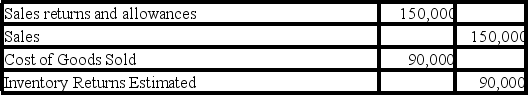

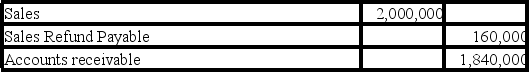

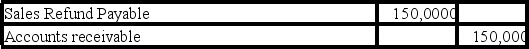

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q136: A company's net sales are $775,420, its

Q160: Using the following year-end information for Bauman,LLC,calculate

Q161: Morgan,Inc.uses a perpetual inventory system and the

Q162: Netherland Corporation has the following unadjusted balances:

Q163: On September 12,Ryan Company sold merchandise in

Q165: On September 12,Ryan Company sold merchandise in

Q167: On September 12,Ryan Company sold merchandise in

Q168: Zenith Company's Merchandise Inventory account at year-end

Q182: A company that uses the net method

Q196: On March 12,Klein Company sold merchandise in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents