Yenhung, who is single, forms a corporation using a tax-free asset transfer, which qualifies under Sec.351.She contributes property having an adjusted basis of $50,000 and an FMV of $40,000.The stock received from the corporation is Sec.1244 stock.When Yenhung sells the stock for $30,000, her loss is

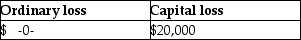

A)

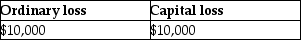

B)

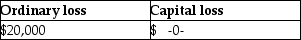

C)

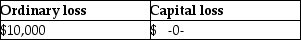

D)

Correct Answer:

Verified

Q6: Nathan is single and owns a 54%

Q13: On January of the current year,Rae purchases

Q70: Identify which of the following statements is

Q74: Lynn transfers land having a $50,000 adjusted

Q74: Martin operates a law practice as a

Q75: A medical doctor incorporates her medical practice,

Q76: Colleen operates a business as a sole

Q79: Jeremy operates a business as a sole

Q110: The City of Springfield donates land worth

Q111: The City of Portland gives Data Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents