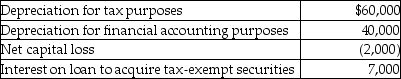

Winter Corporation's taxable income is $500,000.In addition, Winter has the following items:  What is Winter's financial accounting income?

What is Winter's financial accounting income?

A) $511,000

B) $513,000

C) $518,000

D) $520,000

Correct Answer:

Verified

Q69: Lass Corporation reports a $25,000 net capital

Q79: Grant Corporation is not a large corporation

Q82: Identify which of the following statements is

Q84: Access Corporation,a large manufacturer,has a taxable income

Q84: Identify which of the following statements is

Q85: Baxter Corporation is a personal service corporation.Baxter

Q85: Andy owns 20% of North Corporation and

Q86: Glacier Corporation,a large retail sales company,has a

Q88: Identify which of the following statements is

Q96: Davis Corporation,a manufacturer,has taxable income of $150,000.Davis's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents